Commentary

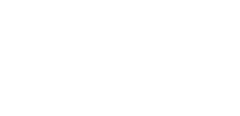

How has the global market performed?

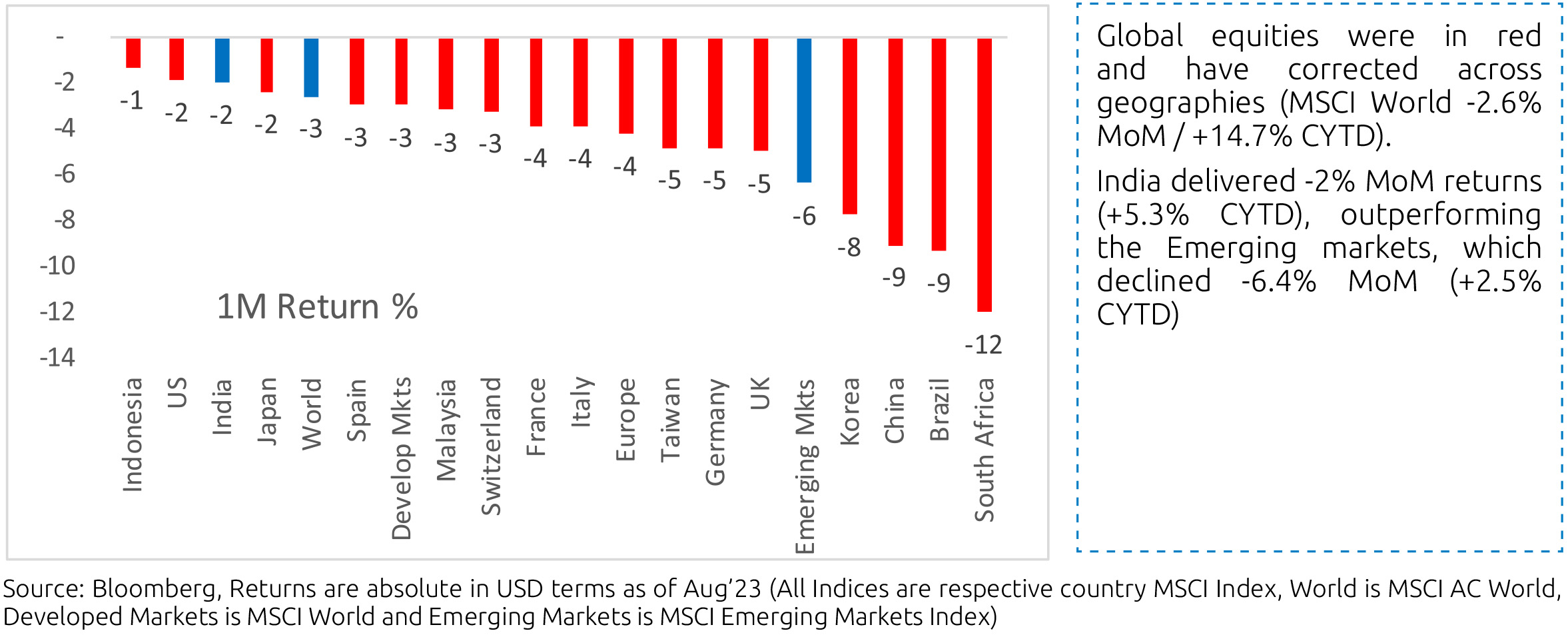

Comparative: India's performance has lagged on both CYTD and 1-year returns. On a 6 months basis, India's performance still stacks up well.

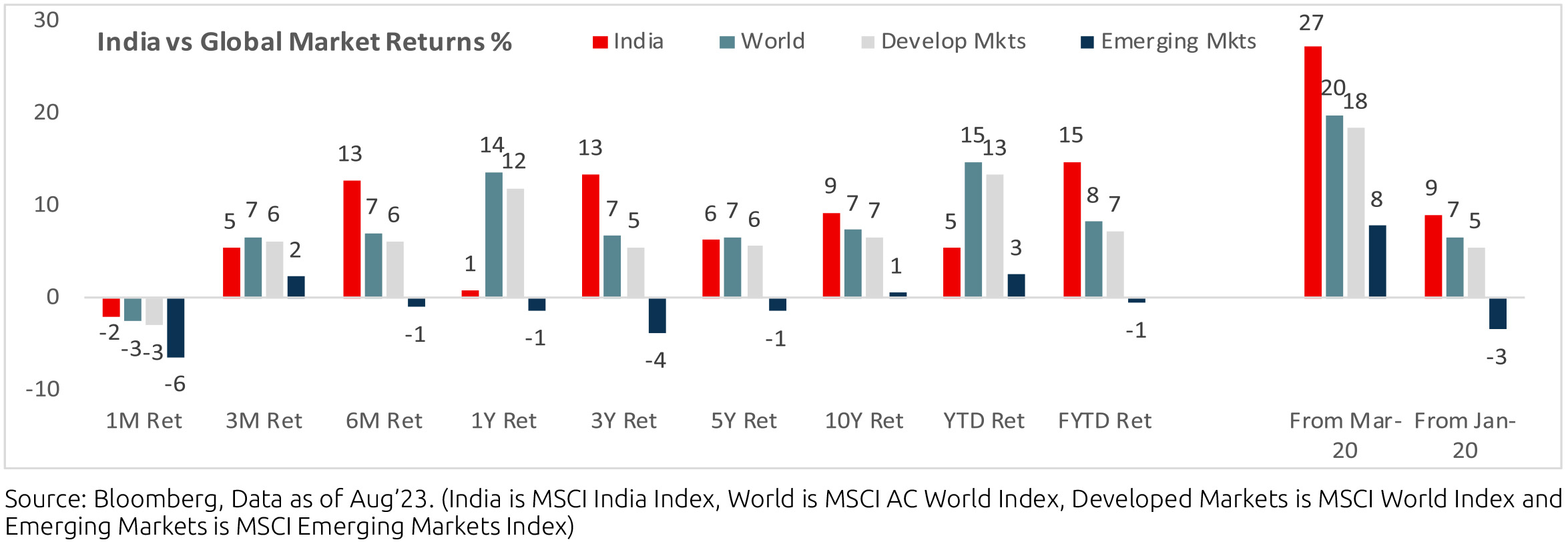

How has the Indian Market performed?

Market Performance

Equity Outlook

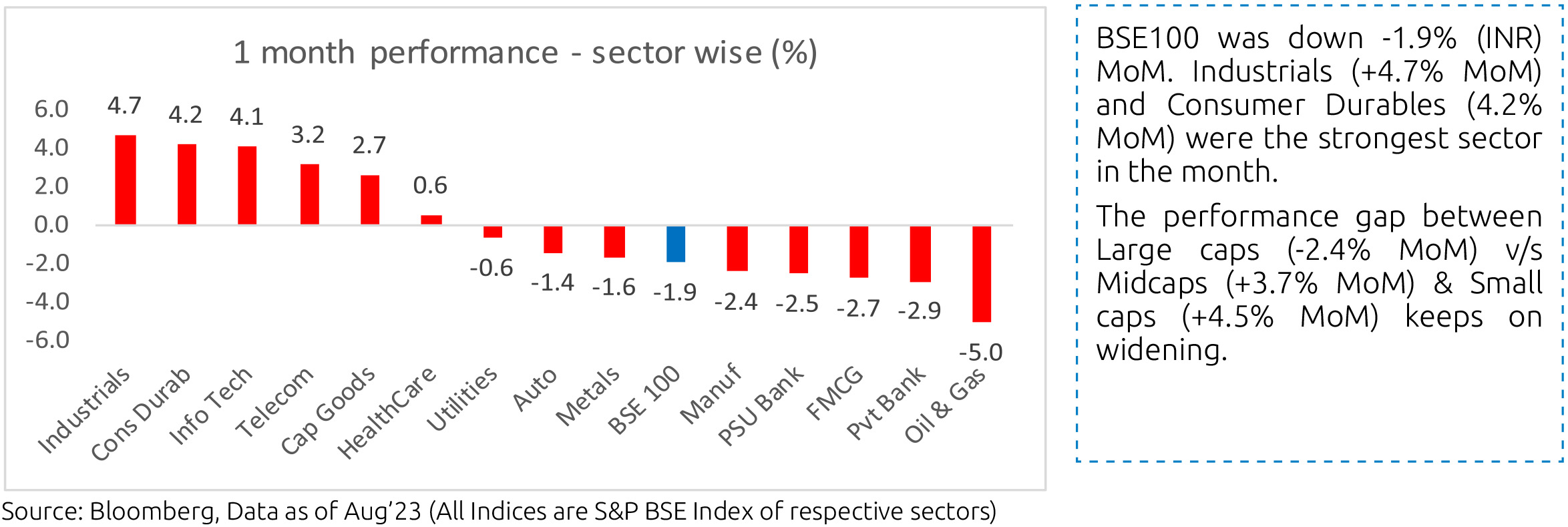

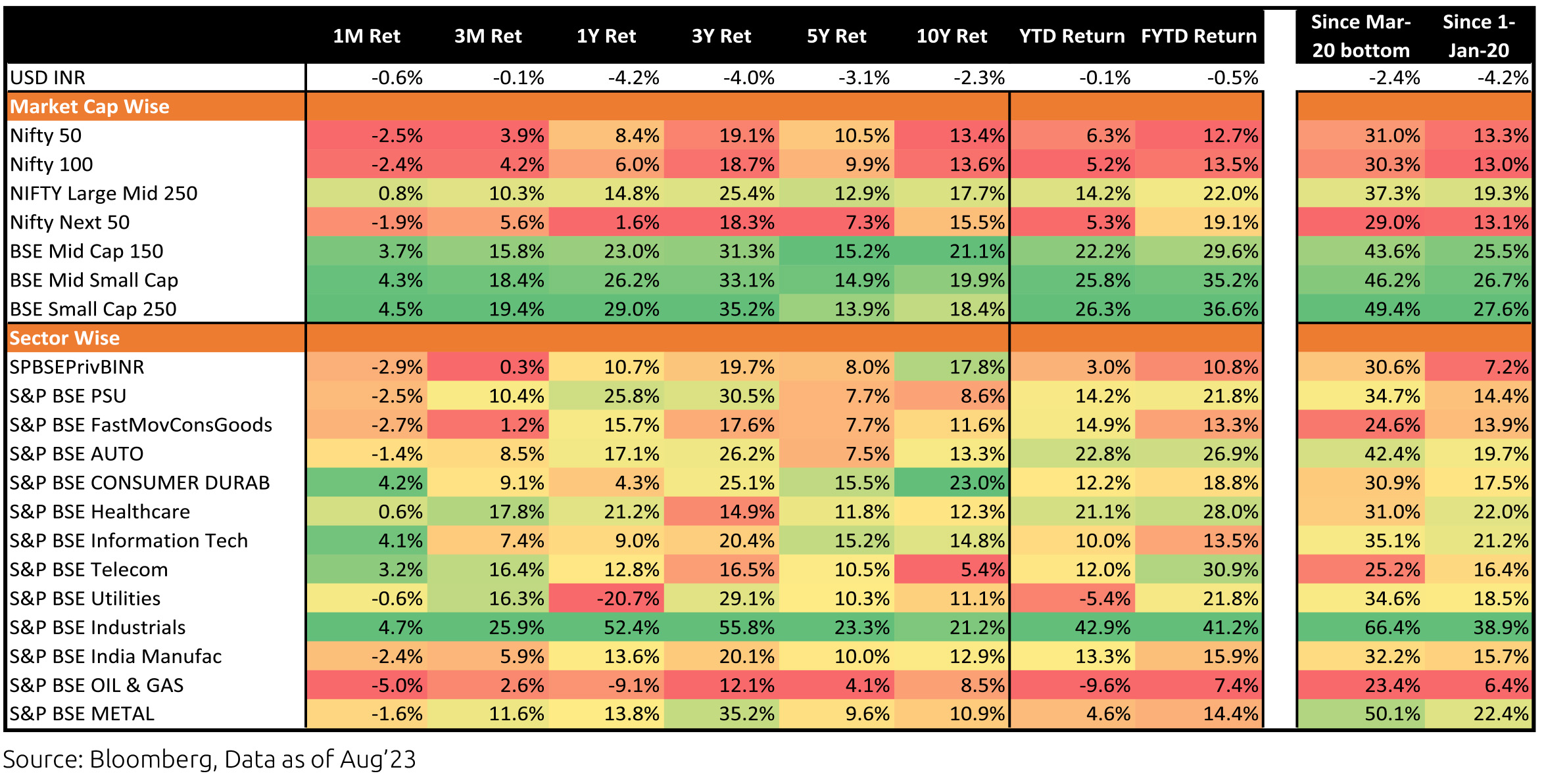

August saw continued outperformance of the small/midcap space over large caps. The small cap indices have rebounded more than 40% since the March bottom, and tactical indicators are skewed towards a possible correction. Recently, the robust outlook on India's macro has been affected slightly by rising oil prices and fiscal deficit slippage, though the impact is not significant. The combination of domestic and global liquidity combined with a resilient economy and corporate earnings profile provides strong market tailwinds.

Overall, we are overweight on domestic sectors like Auto, Industrials, etc., but valuations have become rich, and we are heading into the election period; hence, we must carefully manage the domestic cyclical part of the portfolios. While small caps may see a tactical correction from a medium to long-term perspective, we see interesting opportunities in the space given the country's healthy economic growth, vibrant corporate sector and strong domestic liquidity.

India's nominal GDP growth moderated further to 8% y/y in the June quarter, from 10.4% in the March quarter, but real GDP

growth improved to 7.8% after 6.1% in March. On a seasonally adjusted q/q basis, real GDP growth was 1.7% after 2.1% in March.

Real growth was driven by a pickup in year-on-year private consumption (6% after 2.8% in March) and strong investment but

net exports and government consumption were drags. On the supply side, growth in agriculture, utilities and construction were

slower, that in manufacturing mildly higher but that in services (particularly financial, real estate and professional services) much

stronger on a real y/y basis. Growth in real Core-GVA (GVA excluding Agriculture, forestry & fishing and Public administration,

defence & other services), on a y/y basis, picked up to 8.7% y/y in June from 7.3% in March. This GDP print comes after headline

nominal GDP growth was 16.1% in FY23 (18.4% in FY22) and real GDP growth was 7.2% (9.1% in FY22).

On central government fiscal data for April-July, net tax revenue growth was down 12.6% y/y as corporate tax and excise duties inflow were lower and devolution to states was higher. Total expenditure was up 22.5%y/y, with both revenue and capital expenditure stronger. Small savings collections, however, was stronger by around Rs. 44,000cr from the same period of last year. GST collection remained robust at Rs. 1.6 lakh crore and 11% y/y in August.

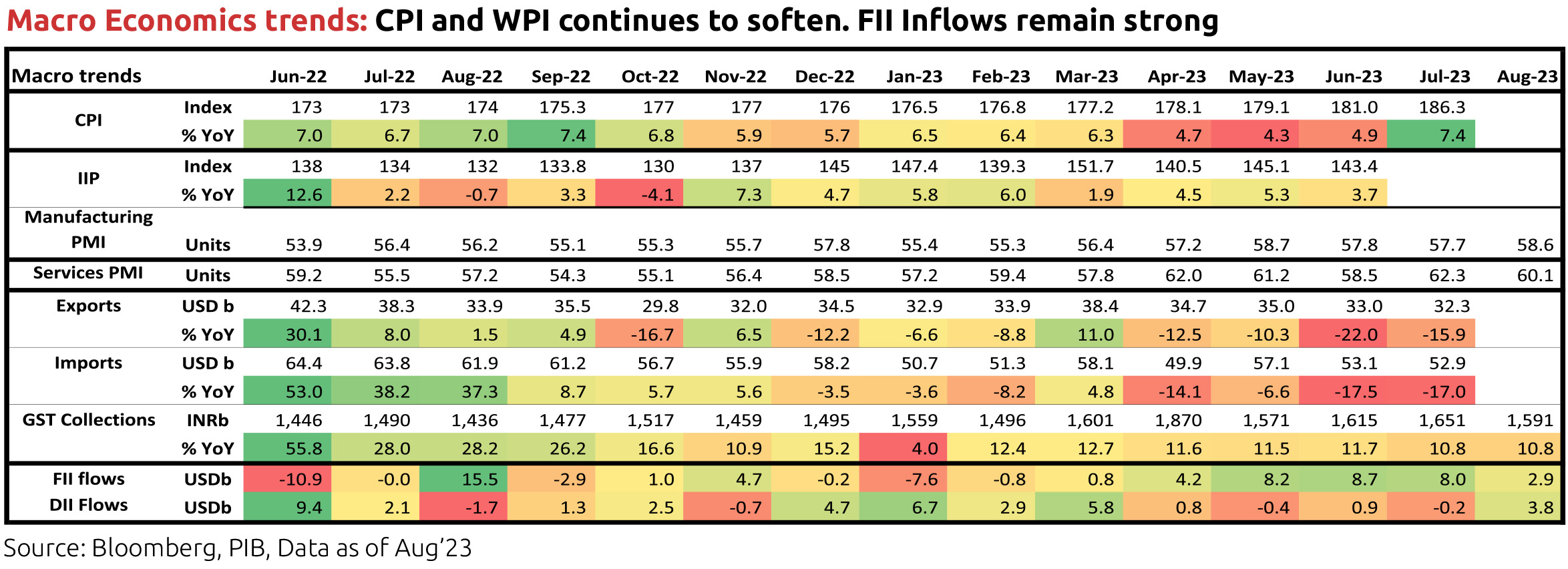

Consumer Price Index (CPI) inflation in India spiked to 7.4% y/y in July after 4.9% in June, mainly driven by a surge in tomato prices. Overall food and beverages price momentum picked up by 5.7% m/m as prices of cereals, pulses, fruits and spices were also strong. However, prices of vegetable oils and meat& fish eased. Core inflation (CPI excluding food and beverages, fuel and light), which averaged 6.1% in FY23, moderated in recent months and eased further to 4.9% y/y in July, also due to base effects. Real time prices of tomatoes have fallen very sharply from mid-August, that of vegetable oils continue to moderate and LPG prices have been cut by the government while prices of cereals, pulses and kerosene have ticked up. Monsoon rainfall picked up in July, but has been very weak from August and global agencies continue to assign a high probability for El Niño conditions to continue at least till end of this year. El Niño is typically associated with lesser southwest monsoon rainfall in India, although not a given, and thus potentially lower agriculture production. Reservoir water levels have also fallen. Kharif crop sowing for rice is slightly higher than last year, but very weak rainfall since August could impact final harvest and crop quality. Sowing in pulses is well below last year levels. Government has been taking various supply side measures (procurement, open market sales, international trade, price rise mitigation, etc.) which also impact agriculture production and food inflation.

Industrial production (IP) growth was 3.7%y/y in June after 5.3% in May. On a seasonally adjusted month-on-month basis, it was -0.4% in June after +1% in May. By category, output momentum continued to pick up for primary goods but it fell for all the others (capital, intermediate, infrastructure & construction, consumer durable and consumer non-durable goods). Infrastructure Industries output (40% weight in IP) fell 1% m/m (seasonally adjusted) in July, as output in cement and electricity fell, although that in coal, crude oil, natural gas and fertilisers improved. Steel output growth moderated.

Bank credit outstanding as on 25th August was 19.8% y/y, including the impact of the merger of a non-bank with a bank. Excluding this, credit growth has moderated from late October 2022. Bank deposit growth is at 13.2% and has averaged 11.3% so far in 2023. Credit flow in FY23 was much higher than in the previous two financial years with strong flows to personal loans (38% of total flow) and services (33% of total flow). Credit flow so far in FY24 (Apr-July) has also been higher towards services and personal loans.

Merchandise trade deficit for July increased to USD 20.7bn, after it had moderated to USD 18.8bn in June. In July, oil exports were down by USD 2.2bn from June and non-oil exports were almost flat. However, oil imports were down by USD 0.8bn and gold imports by USD 1.5bn but non-oil-non-gold imports increased by USD 2.1bn. Trade deficit, after peaking in September 2022 at USD 28bn, had moderated before the pickup in May 2023. Services trade surplus surprised to the upside from late 2022 with an average monthly surplus of USD 13.4bn in H2 FY23 vs. USD 10.4bn in H1 FY23. This was at USD 12.3bn in July and averaged USD 12.1bn in Q1 FY24, after USD 15.5bn in December and USD 13.7bn average in Q4 FY23.

Among higher-frequency variables, number of two-wheelers registered eased after the pickup in October 2022, stayed moderate but has improved a bit since mid of August. Energy consumption levels have picked up recently (although it moderated a bit in the last five days) and averaged 12.7% y/y during the week ending 07 September 2023. Monthly number of GST e-way bills generated picked up to 9.3cr units in August from 8.8cr in July and an average of 8.6cr in the June quarter.

US headline CPI was at 3.2% y/y in July after 3% in June, with base effects also in play. In July, price momentum in energy goods moderated, that in used vehicles was further negative but that in food & beverages and rent of shelter were mildly higher. Core CPI was at 4.7% in July after 4.8% in June. Sequential momentum in headline and core CPI were almost flat but that in non-housing-core-services moved up. US non-farm payroll addition in August (187,000 persons) was slightly above expectation but that in June and July were revised down. However, unemployment rate inched up to 3.8% in August from 3.5% in July, Employment-Population ratio was flat and Labour Force Participation Rate inched up. Further, sequential growth in average hourly earnings moderated to 0.2% in August from 0.4% in July. Non-farm job openings as per the Job Openings and Labor Turnover Survey (JOLTS) fell more than expected to 8.8mn in July from 9.2mn in June and 10.3mn in April, and the job-openingto- hires ratio for the non-farm sector is now 1.53, off the peak of 1.83 in March 2022 but higher than the pre-pandemic average of 1.18 in Jan-Feb 2020.

In the US banking sector, after the issues in March this year and the Fed responding with liquidity support measures and enabling the takeover of small and regional banks which failed, deposit outflow (particularly from small banks) has stabilized. The FOMC (Federal Open Market Committee), after raising the target range for the federal funds rate in ten consecutive meetings from March 2022 by a total of 500bps, paused at its June meeting and then hiked again by 25bps (to the 5.25-5.50% range) at its July meeting. It welcomed the lower June CPI print but stressed on the need to see further and sustainable progress, said it can hold or hike rates at its September meeting depending on labour and inflation data, that its staff no longer forecasts a US recession and that any rate cuts next year can co-exist with Fed balance sheet size reduction. In June, it had increased its median projection for the fed funds rate for 2023 by 50bps (to 5.6%) and for 2024 by 30bps (to 4.6%).

The European Central Bank's Governing (ECB) Council in its monetary policy decision in July raised all the three key interest rates again by 25bps, a total of 425bps so far in this cycle. It continued to acknowledge weaker growth, and said the momentum in the services sector is now slowing. As the energy crisis fades, it said drivers of inflation is now shifting from external to domestic (i.e. rising wages and robust profit margins) sources. It changed the official statement slightly to 'Our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to our two per cent medium-term target' and said it will remain data-dependent going forward on interest rate decisions. Further, as per the July 2023 Euro Area bank lending survey, credit standards tightened further for all loan categories and demand from firms for loans in Q2 2023 dropped to an all-time low since the start of the survey in 2003, mainly driven by rising interest rates and lower financing needs for fixed investment.

Outlook

The sovereign curve has continued to trade in a tight range for the month of August with the yield curve flattening by 3-5 bps. CPI for the month of August printed at 7.44% almost 100 bps higher than market expectations. Post CPI announcement yield on the benchmark 10Y bond rose to a high of 7.25% before softening again toward the end of the month. Corporate bond spreads in both the AAA and credit space continue to trade at compressed spreads. With the approach of the busy season and lower net government borrowing in H2, these spreads could face upward pressure. Post the I-CRR hike overnight rates have hovered close to the MSF rate of 6.75% for the most part. Money market rates have inched up marginally due to increased supply and prospects of liquidity remaining tight till the end of September.

The market seems to be caught between a constructive medium-term outlook and rising concerns in the near term. The recent rise in crude oil prices and volatility in vegetable prices have clouded the domestic inflation outlook. Meanwhile, most market participants still expect the rate hikes by various central banks to eventually have an increasing impact and lead to an economic slowdown if not outright recession. In addition, the renewed market chatter and media reports regarding the prospects of India's inclusion in global bond indices have added another near-term trigger.

Notwithstanding the recent spike in CPI, we believe that we are at the terminal rate in the current cycle. At this juncture, while being watchful, we choose to look through the near-term headwinds and believe that the 3-6 year point on the sovereign curve offers the most value.

On central government fiscal data for April-July, net tax revenue growth was down 12.6% y/y as corporate tax and excise duties inflow were lower and devolution to states was higher. Total expenditure was up 22.5%y/y, with both revenue and capital expenditure stronger. Small savings collections, however, was stronger by around Rs. 44,000cr from the same period of last year. GST collection remained robust at Rs. 1.6 lakh crore and 11% y/y in August.

Consumer Price Index (CPI) inflation in India spiked to 7.4% y/y in July after 4.9% in June, mainly driven by a surge in tomato prices. Overall food and beverages price momentum picked up by 5.7% m/m as prices of cereals, pulses, fruits and spices were also strong. However, prices of vegetable oils and meat& fish eased. Core inflation (CPI excluding food and beverages, fuel and light), which averaged 6.1% in FY23, moderated in recent months and eased further to 4.9% y/y in July, also due to base effects. Real time prices of tomatoes have fallen very sharply from mid-August, that of vegetable oils continue to moderate and LPG prices have been cut by the government while prices of cereals, pulses and kerosene have ticked up. Monsoon rainfall picked up in July, but has been very weak from August and global agencies continue to assign a high probability for El Niño conditions to continue at least till end of this year. El Niño is typically associated with lesser southwest monsoon rainfall in India, although not a given, and thus potentially lower agriculture production. Reservoir water levels have also fallen. Kharif crop sowing for rice is slightly higher than last year, but very weak rainfall since August could impact final harvest and crop quality. Sowing in pulses is well below last year levels. Government has been taking various supply side measures (procurement, open market sales, international trade, price rise mitigation, etc.) which also impact agriculture production and food inflation.

Industrial production (IP) growth was 3.7%y/y in June after 5.3% in May. On a seasonally adjusted month-on-month basis, it was -0.4% in June after +1% in May. By category, output momentum continued to pick up for primary goods but it fell for all the others (capital, intermediate, infrastructure & construction, consumer durable and consumer non-durable goods). Infrastructure Industries output (40% weight in IP) fell 1% m/m (seasonally adjusted) in July, as output in cement and electricity fell, although that in coal, crude oil, natural gas and fertilisers improved. Steel output growth moderated.

Bank credit outstanding as on 25th August was 19.8% y/y, including the impact of the merger of a non-bank with a bank. Excluding this, credit growth has moderated from late October 2022. Bank deposit growth is at 13.2% and has averaged 11.3% so far in 2023. Credit flow in FY23 was much higher than in the previous two financial years with strong flows to personal loans (38% of total flow) and services (33% of total flow). Credit flow so far in FY24 (Apr-July) has also been higher towards services and personal loans.

Merchandise trade deficit for July increased to USD 20.7bn, after it had moderated to USD 18.8bn in June. In July, oil exports were down by USD 2.2bn from June and non-oil exports were almost flat. However, oil imports were down by USD 0.8bn and gold imports by USD 1.5bn but non-oil-non-gold imports increased by USD 2.1bn. Trade deficit, after peaking in September 2022 at USD 28bn, had moderated before the pickup in May 2023. Services trade surplus surprised to the upside from late 2022 with an average monthly surplus of USD 13.4bn in H2 FY23 vs. USD 10.4bn in H1 FY23. This was at USD 12.3bn in July and averaged USD 12.1bn in Q1 FY24, after USD 15.5bn in December and USD 13.7bn average in Q4 FY23.

Among higher-frequency variables, number of two-wheelers registered eased after the pickup in October 2022, stayed moderate but has improved a bit since mid of August. Energy consumption levels have picked up recently (although it moderated a bit in the last five days) and averaged 12.7% y/y during the week ending 07 September 2023. Monthly number of GST e-way bills generated picked up to 9.3cr units in August from 8.8cr in July and an average of 8.6cr in the June quarter.

US headline CPI was at 3.2% y/y in July after 3% in June, with base effects also in play. In July, price momentum in energy goods moderated, that in used vehicles was further negative but that in food & beverages and rent of shelter were mildly higher. Core CPI was at 4.7% in July after 4.8% in June. Sequential momentum in headline and core CPI were almost flat but that in non-housing-core-services moved up. US non-farm payroll addition in August (187,000 persons) was slightly above expectation but that in June and July were revised down. However, unemployment rate inched up to 3.8% in August from 3.5% in July, Employment-Population ratio was flat and Labour Force Participation Rate inched up. Further, sequential growth in average hourly earnings moderated to 0.2% in August from 0.4% in July. Non-farm job openings as per the Job Openings and Labor Turnover Survey (JOLTS) fell more than expected to 8.8mn in July from 9.2mn in June and 10.3mn in April, and the job-openingto- hires ratio for the non-farm sector is now 1.53, off the peak of 1.83 in March 2022 but higher than the pre-pandemic average of 1.18 in Jan-Feb 2020.

In the US banking sector, after the issues in March this year and the Fed responding with liquidity support measures and enabling the takeover of small and regional banks which failed, deposit outflow (particularly from small banks) has stabilized. The FOMC (Federal Open Market Committee), after raising the target range for the federal funds rate in ten consecutive meetings from March 2022 by a total of 500bps, paused at its June meeting and then hiked again by 25bps (to the 5.25-5.50% range) at its July meeting. It welcomed the lower June CPI print but stressed on the need to see further and sustainable progress, said it can hold or hike rates at its September meeting depending on labour and inflation data, that its staff no longer forecasts a US recession and that any rate cuts next year can co-exist with Fed balance sheet size reduction. In June, it had increased its median projection for the fed funds rate for 2023 by 50bps (to 5.6%) and for 2024 by 30bps (to 4.6%).

The European Central Bank's Governing (ECB) Council in its monetary policy decision in July raised all the three key interest rates again by 25bps, a total of 425bps so far in this cycle. It continued to acknowledge weaker growth, and said the momentum in the services sector is now slowing. As the energy crisis fades, it said drivers of inflation is now shifting from external to domestic (i.e. rising wages and robust profit margins) sources. It changed the official statement slightly to 'Our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to our two per cent medium-term target' and said it will remain data-dependent going forward on interest rate decisions. Further, as per the July 2023 Euro Area bank lending survey, credit standards tightened further for all loan categories and demand from firms for loans in Q2 2023 dropped to an all-time low since the start of the survey in 2003, mainly driven by rising interest rates and lower financing needs for fixed investment.

Outlook

The sovereign curve has continued to trade in a tight range for the month of August with the yield curve flattening by 3-5 bps. CPI for the month of August printed at 7.44% almost 100 bps higher than market expectations. Post CPI announcement yield on the benchmark 10Y bond rose to a high of 7.25% before softening again toward the end of the month. Corporate bond spreads in both the AAA and credit space continue to trade at compressed spreads. With the approach of the busy season and lower net government borrowing in H2, these spreads could face upward pressure. Post the I-CRR hike overnight rates have hovered close to the MSF rate of 6.75% for the most part. Money market rates have inched up marginally due to increased supply and prospects of liquidity remaining tight till the end of September.

The market seems to be caught between a constructive medium-term outlook and rising concerns in the near term. The recent rise in crude oil prices and volatility in vegetable prices have clouded the domestic inflation outlook. Meanwhile, most market participants still expect the rate hikes by various central banks to eventually have an increasing impact and lead to an economic slowdown if not outright recession. In addition, the renewed market chatter and media reports regarding the prospects of India's inclusion in global bond indices have added another near-term trigger.

Notwithstanding the recent spike in CPI, we believe that we are at the terminal rate in the current cycle. At this juncture, while being watchful, we choose to look through the near-term headwinds and believe that the 3-6 year point on the sovereign curve offers the most value.