Commentary

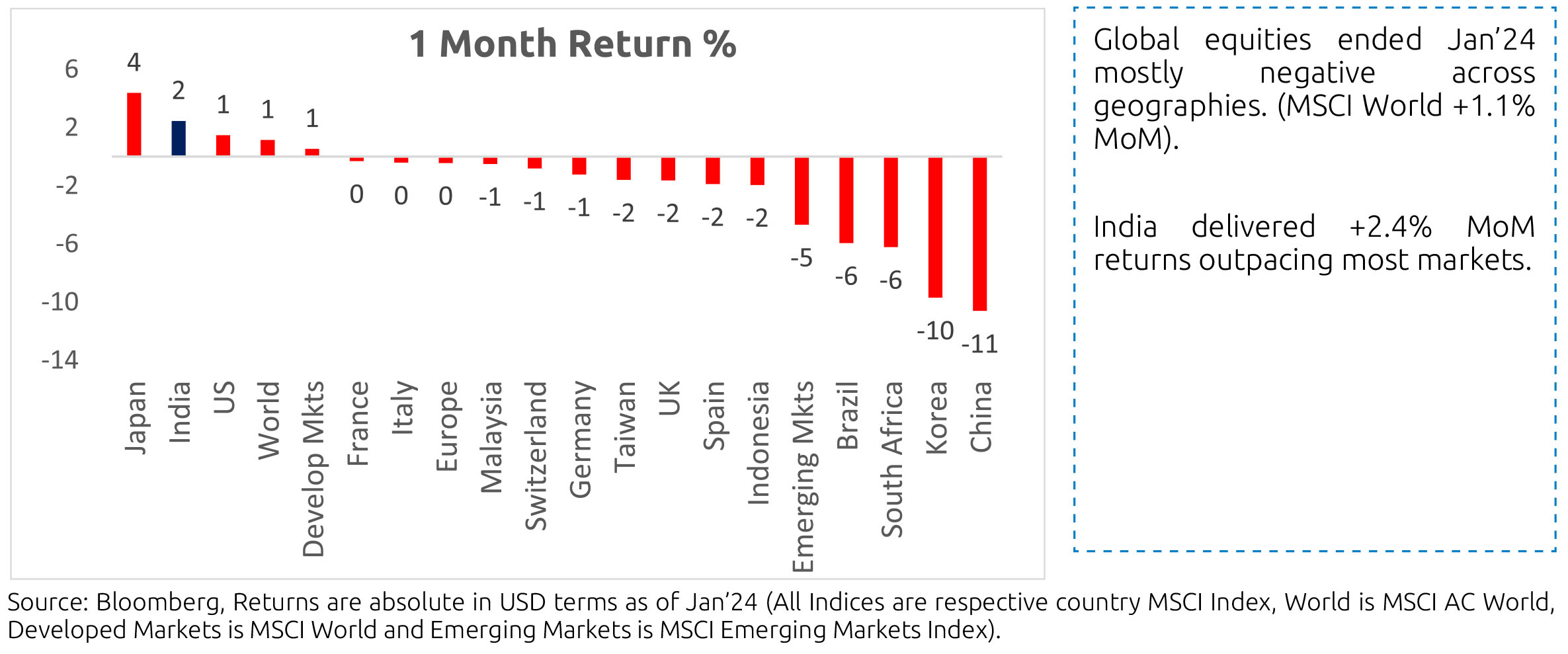

How has the global market performed?

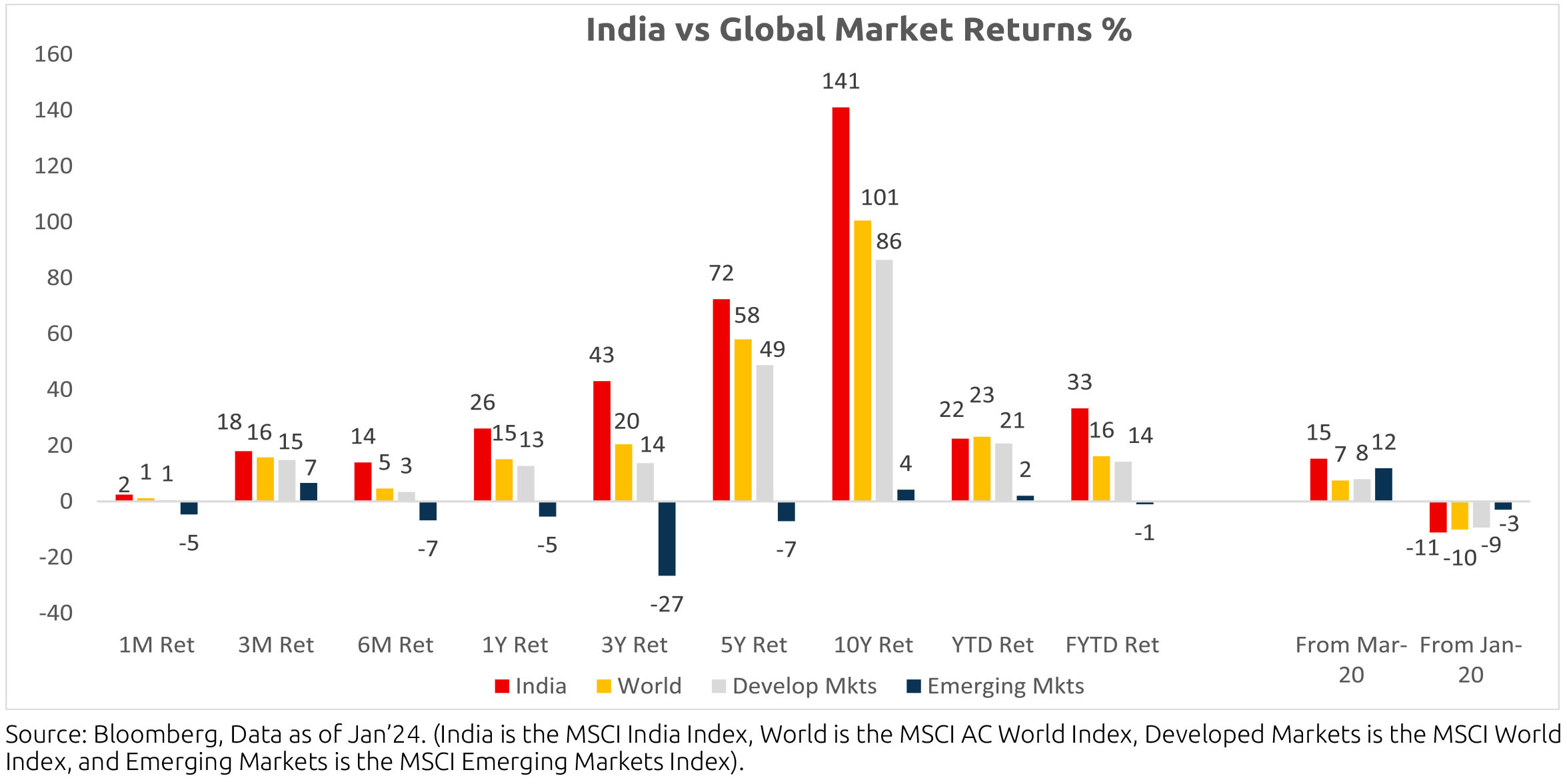

Comparative: India's performance is much better YTD and leads the pack across all other horizons and geographies

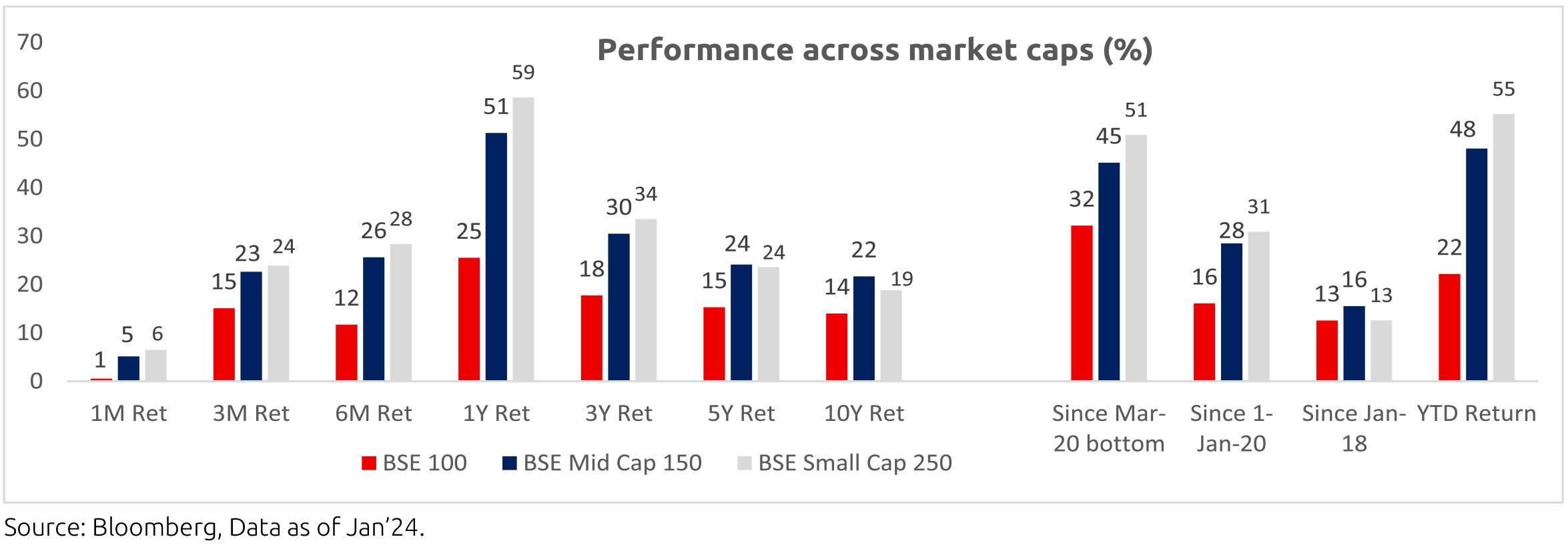

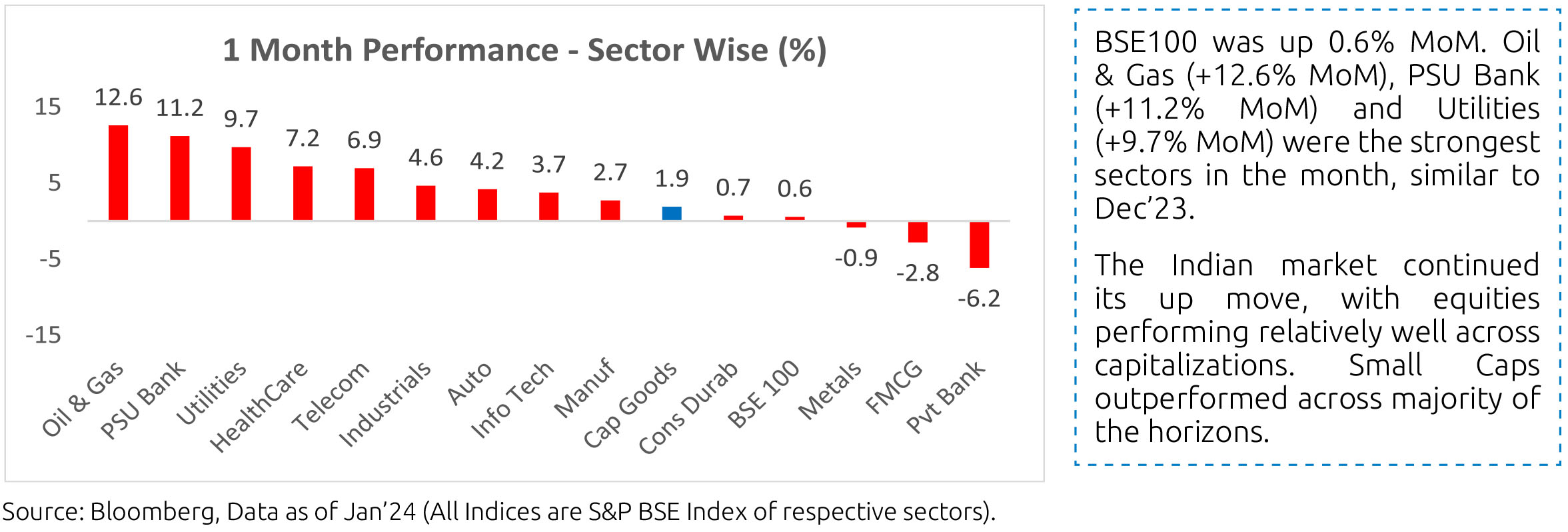

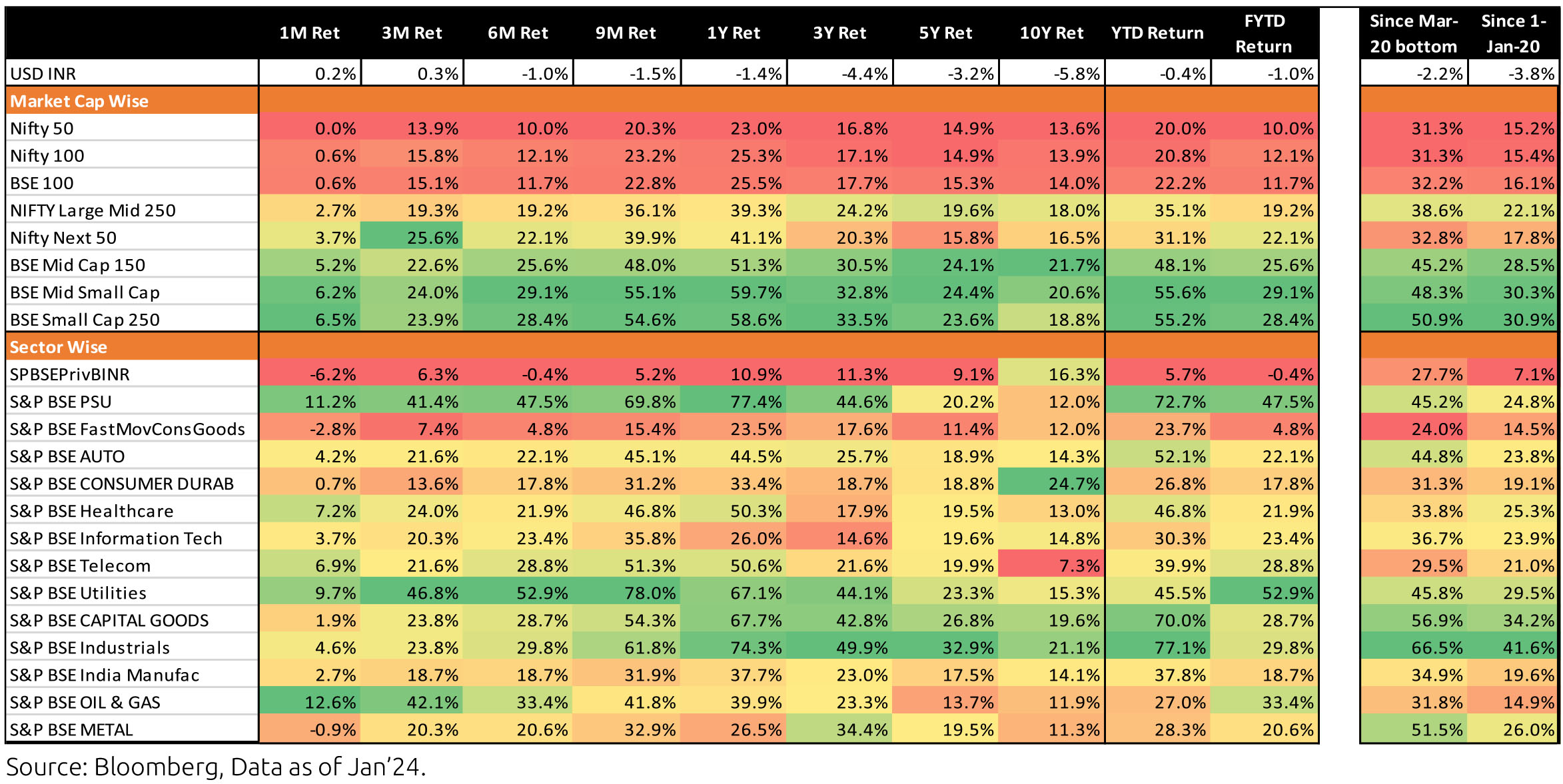

How has the Indian Market performed?

Market Performance

EQUITY OUTLOOK

The market is seeing a fairly sharp rotation from high quality growth stocks to value/PSU stocks which has accelerated

post state election results. Domestic liquidity has been strong and while FII flows are weak but the foreign interest

to invest in India is robust given stable growth and attractive currency fundamentals. The broader market continues

to outperform the headline index.As the value stocks have done well over the last couple of years, we are selectively trimming exposure and reducing our sector deviations. We continue to be largely overweight on domestic sectors compared to export and commodity sectors.

India's union budget for 2024-25 continued to focus on fiscal consolidation, estimated fiscal deficit for FY24 at 5.8% of GDP

and for FY25 at 5.1% in line with the fiscal glide path to get to less than 4.5% by FY26. However, it retained it's focus on capital

expenditure too. This implies the overall deficit of the public sector (central government + state governments + Central PSEs)

is estimated to fall to 8.7% of GDP in FY25, form the peak of 15.2% in FY21 and below the pre-pandemic level of 9.7% in FY20.

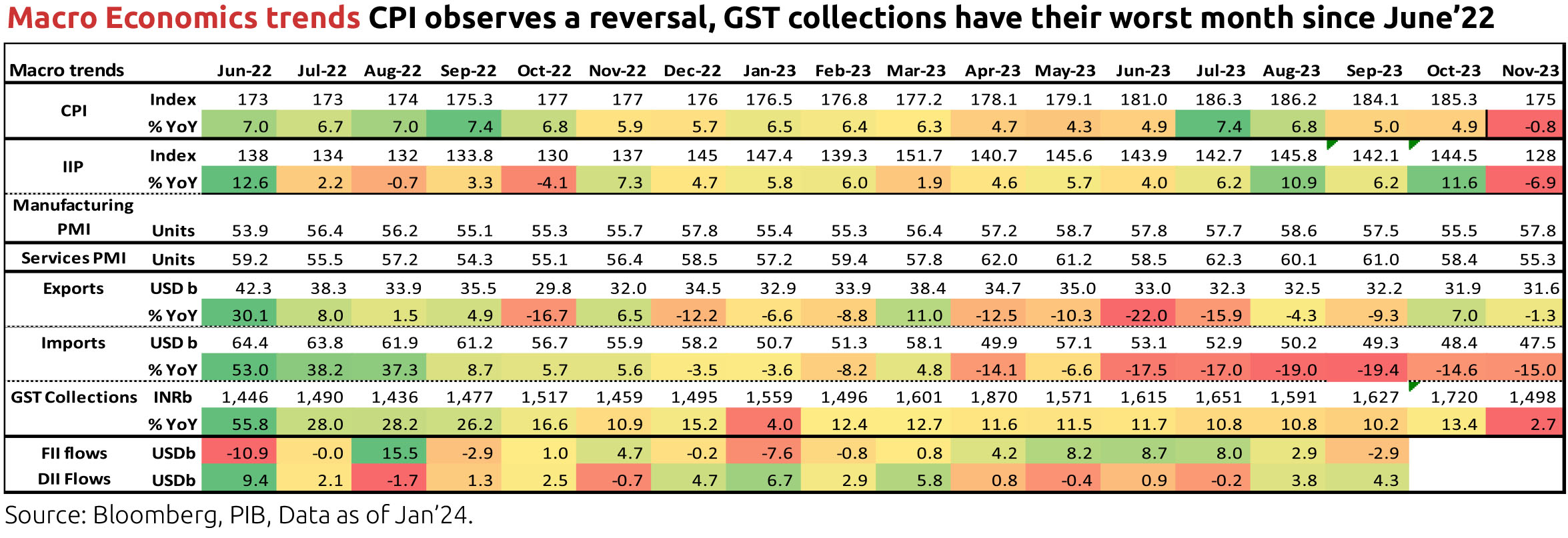

As per the central government fiscal data for April-December, net tax revenue growth was up 11.2% y/y, as direct tax collections picked up but so did devolution of taxes to states. Total expenditure was up 8.4%y/y, although both revenue and capital expenditure picked up in December. Fiscal deficit so far is 56.6% of the revised estimate for FY24 vs. 57.1% during the same period last year (latter as % of actuals). In terms of financing the fiscal deficit, small savings collection was stronger by around Rs. 79,000cr from the same period of last year. In January, GST collection was at Rs. 1.72 lakh crore and 10.4% y/y.

India's Consumer Price Index (CPI) inflation eased to 4.9% in October but the sequential momentum in food and beverages picked up in October and November, driven by vegetables, pulses, eggs, etc. Thus, November CPI increased to 5.6% and December CPI was at 5.7% but the latter reading was marked by an underlying easing in food price momentum. Core inflation (CPI excluding food and beverages, fuel and light), which averaged 6.1% in FY23, has been moderating and eased further to 3.9% y/y in December, also due to base effects. Real time prices of potato, onion, pulses, some of the vegetable oils, etc. are now easing. Global weather forecasting agencies predict El Niño (typically associated with lesser rainfall in India and thus lower agriculture production) to continue into 2024. However, government has been taking various supply side measures related to procurement, open market sales, international trade, price rise mitigation, etc.

Industrial production (IP) growth was 2.4% y/y in November after 11.6% in October. On a seasonally adjusted month-on-month basis, it was -0.6% in November after +0.1% in October. Output momentum was negative for primary, capital, intermediate, infrastructure & construction goods while it was positive for consumer durables and non-durable goods. Infrastructure Industries output (40% weight in IP) increased 0.7% m/m (seasonally adjusted) in December, as output momentum in cement turned up strongly from November.

Bank credit outstanding as on 26th January was 20.3% y/y, including the impact of the merger of a non-bank with a bank from 01 July 2023. Latest bank deposit growth is at 13.2%. Credit flow in FY23 was much higher than in the previous two financial years with strong flows to personal loans (38% of total flow) and services (33% of total flow). Credit flow in FY24 (April-December) has also been higher towards personal loans and services. More recently, on 16th November, the RBI raised risk weights for commercial banks' and NBFCs' categories of unsecured personal loans (including bank credit to NBFCs).

Merchandise trade deficit for December eased further to USD 19.8bn from USD 20.6bn in November and the sharp rise to USD 30bn in October. In December, oil trade deficit increased m/m by USD 0.6bn and non-oil-non-gold imports increased by USD 4.2bn. However, gold imports fell by USD 0.4bn and non-oil exports picked up by USD 5.2bn. Services trade surplus (which surprised to the upside from late 2022 with an average monthly surplus of USD 13.3bn in H2 FY23 vs. USD 10.9bn in H1 FY23) was at USD 14.6bn in December after USD 14.4bn in November. It averaged USD 12.5bn in H1 FY24.

Among higher-frequency variables, number of two-wheelers registered picked up sharply in November (due to the festive season) but has moderated from December. Energy consumption levels have averaged 7.3% y/y during the week ending 07 February 2024. Monthly number of GST e-way bills was 9.5cr units in December (after 8.8cr in November) and averaged 9.4cr in the December quarter.

US headline CPI was at 3.4% y/y in December, after 3.1% in November. In December, price momentum in energy goods, apparel, recreation, education and communication turned positive, while that in used vehicles eased. Momentum in housing moderated mildly but stayed strong. Core CPI was at 3.9% in December after 4% in October and November. Sequential momentum in headline CPI and core CPI increased while that in non-housing-core-services stayed high. US non-farm payroll addition in January (353,000 persons) was well above expectation and numbers for the recent months were revised up too. Growth in average hourly earnings increased to 0.6% m/m in January but that in average weekly earnings fell as the average weekly hours worked fell. The unemployment rate stayed flat at 3.7% and the labour force participation rate at 62.5%. Non-farm job openings as per the Job Openings and Labor Turnover Survey (JOLTS) picked up very mildly in November and December, with hires falling in November and quits falling in November and December. The job-opening-to-hires ratio for the non-farm sector is now 1.61, off the peak of 1.83 in March 2022 but higher than the pre-pandemic average of 1.18 in Jan-Feb 2020.

The FOMC (Federal Open Market Committee), left its policy rate unchanged again at its meeting in January (after doing the same since September) at 5.25-5.50%. The last hike was in July and it had hiked rates at every meeting from March 2022 to May 2023. However, the December 2023 meeting marked a pivot in the Fed's policy from potentially hiking rates further to likely no more hikes and to even discussing rate cuts this year. At the January meeting, it said economic activity was continuing to expand at a solid pace, employment and inflation goals are moving into better balance but that it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. The Fed Governor thus stressed on the need to see more good inflation data (same pace of disinflation seen in the las six months). Thus, although a 75bps rate cut is expected this year as per the Committee's Summary of Economic Projections from December 2023, the Governor said it will be unlikely the Committee will reach a level of confidence by the March meeting to start cutting rates. He also said the committee had some discussions this meeting on tapering the ongoing reduction of the Fed's balance sheet (i.e. tapering Quantitative Tightening) and that it plans to begin in-depth discussions on this in the March meeting.

In the February'24 monetary policy, RBI / MPC kept all rates unchanged as expected. The general assessment on growth is that of continued resilience backed by the momentum in investment demand, optimistic business sentiments and rising consumer confidence. This is also reflected in the GDP forecast for FY 25. On inflation, the progress on core inflation is noted and welcomed but so is the repeated occurrence of food shocks that is interrupting the pace of disinflation. Further supply side risks come from international geopolitical uncertainties.

The underlying template for now seems similar for RBI and the Fed: strong growth is allowing for monetary policy to be patient in seeing through the attainment of respective inflation targets. More specifically, and focusing on the Indian context now, with price volatility driven by supply side factors resurfacing from time to time in context of robust underlying growth, there is always a chance of inflation pressures generalising. Put another way, the central bank has the luxury to not try and take a forward looking call (e.g. try to anticipate the effect on aggregate demand going ahead from fiscal compression shown in the just concluded interim budget) since concurrent growth if anything is stronger than what was earlier forecasted and doesn't need any support for now from monetary policy.

RBI's liquidity approach has evolved since late last year. Thus while the entire rate hike cycle was conducted in an environment of abundantly surplus liquidity, since late last year the central bank had started to worry about the quantum of excess system liquidity as well. This was presumably to facilitate greater transmission from banks. In the most recent period, however, RBI has become more responsive to anchoring overnight rate towards repo. While the Governor has noted that core liquidity remains positive, this is expected to progressively deteriorate into the financial year end predominantly on account of seasonal rise in currency in circulation. This, alongside ongoing large fluctuations in government cash balance, may require continued active intervention to anchor overnight rates. In all likelihood, overnight rates will range between repo and MSF over the next month and a half; with zero tolerance from RBI for it falling below repo rate. Alongside continued pressure of issuances, this should keep corporate bond spreads elevated over this period.

With respect to the conditions accompanying the current monetary policy stance (incomplete transmission and inflation above 4%), these are valid only so long as growth momentum holds. If that changes, then the current projection on inflation will be sufficient for both a stance change as well as follow up rate cuts, in our view. Projected real policy rate considerations are immaterial today given the strong growth momentum, but won't be if this starts to change. To clarify, we aren't arguing for any significant drawdown in growth trajectory. It is well understood that India's structural growth drivers are strong. However, global cyclicality, fiscal compression, and the lagged impact of rate hikes are all reasons to expect some momentum slowdown in the year ahead. This, alongside the start of rate cuts in US and Europe around mid-year, should be enough to give more weight to voices within the MPC that are also closely tracking the evolution of real policy rates. Presumably Prof. Varma's is one such voice, although we agree with the majority MPC that it is somewhat premature to be already actively contemplating rate cuts.

Outlook

We were open to the idea of some soft indications of an impending shift in the liquidity stance, if only to determine whether RBI's response to overnight fluctuations around the repo rate will be symmetrical or not. In the post policy press conference, Deputy Governor Patra did assert (later reiterated by Governor Das) that the objective is to keep weighted average overnight rate at repo rate. However, we would await further action here to be confident that this will indeed be the case, especially with anticipated declining core liquidity. That said, there isn't much in the form of additional takeaways from the policy in our view. It is appropriate to continue to focus on inflation so long as growth momentum is this strong. However, the guidance may not be a line in stone and considerations like real policy rate may gain more weightage as growth momentum slows.

Our bullish view on bonds isn't predicated on an early or deep rate cut cycle (https://bandhanmutual.com/article/15865), but rather on the ongoing transformation in India's underlying macro economic dynamics in context of greater foreign participation given impending bond index inclusion. This has potential to cut risk premia on bonds which most likely will be seen in continued compression in term premia. Thus bond performance is not as constrained by the extent of rate cuts as it would be if the starting point was flatter term premia (overnight rate to duration bond yield) and if one was only playing duration for cycle reasons. In fact, the view that one needs to be less tactical and more structural is even stronger post the budget where we, along with everyone else, have been very pleasantly surprised with the extent of fiscal consolidation the Finance Minister has put on the table.

We continue with overweight 30 year government bonds in our active duration and gilt funds. More broadly, we reiterate that focus of investors should be on appropriate duration enhancement as per risk appetite and a greater focus on quality bonds, unlike the focus on minimizing duration and maximizing carry that has been the dominant theme over the past couple of years.

Data Source: CEIC, PIB, US Federal Reserve, Bandhan MF Research. Data as on latest available

As per the central government fiscal data for April-December, net tax revenue growth was up 11.2% y/y, as direct tax collections picked up but so did devolution of taxes to states. Total expenditure was up 8.4%y/y, although both revenue and capital expenditure picked up in December. Fiscal deficit so far is 56.6% of the revised estimate for FY24 vs. 57.1% during the same period last year (latter as % of actuals). In terms of financing the fiscal deficit, small savings collection was stronger by around Rs. 79,000cr from the same period of last year. In January, GST collection was at Rs. 1.72 lakh crore and 10.4% y/y.

India's Consumer Price Index (CPI) inflation eased to 4.9% in October but the sequential momentum in food and beverages picked up in October and November, driven by vegetables, pulses, eggs, etc. Thus, November CPI increased to 5.6% and December CPI was at 5.7% but the latter reading was marked by an underlying easing in food price momentum. Core inflation (CPI excluding food and beverages, fuel and light), which averaged 6.1% in FY23, has been moderating and eased further to 3.9% y/y in December, also due to base effects. Real time prices of potato, onion, pulses, some of the vegetable oils, etc. are now easing. Global weather forecasting agencies predict El Niño (typically associated with lesser rainfall in India and thus lower agriculture production) to continue into 2024. However, government has been taking various supply side measures related to procurement, open market sales, international trade, price rise mitigation, etc.

Industrial production (IP) growth was 2.4% y/y in November after 11.6% in October. On a seasonally adjusted month-on-month basis, it was -0.6% in November after +0.1% in October. Output momentum was negative for primary, capital, intermediate, infrastructure & construction goods while it was positive for consumer durables and non-durable goods. Infrastructure Industries output (40% weight in IP) increased 0.7% m/m (seasonally adjusted) in December, as output momentum in cement turned up strongly from November.

Bank credit outstanding as on 26th January was 20.3% y/y, including the impact of the merger of a non-bank with a bank from 01 July 2023. Latest bank deposit growth is at 13.2%. Credit flow in FY23 was much higher than in the previous two financial years with strong flows to personal loans (38% of total flow) and services (33% of total flow). Credit flow in FY24 (April-December) has also been higher towards personal loans and services. More recently, on 16th November, the RBI raised risk weights for commercial banks' and NBFCs' categories of unsecured personal loans (including bank credit to NBFCs).

Merchandise trade deficit for December eased further to USD 19.8bn from USD 20.6bn in November and the sharp rise to USD 30bn in October. In December, oil trade deficit increased m/m by USD 0.6bn and non-oil-non-gold imports increased by USD 4.2bn. However, gold imports fell by USD 0.4bn and non-oil exports picked up by USD 5.2bn. Services trade surplus (which surprised to the upside from late 2022 with an average monthly surplus of USD 13.3bn in H2 FY23 vs. USD 10.9bn in H1 FY23) was at USD 14.6bn in December after USD 14.4bn in November. It averaged USD 12.5bn in H1 FY24.

Among higher-frequency variables, number of two-wheelers registered picked up sharply in November (due to the festive season) but has moderated from December. Energy consumption levels have averaged 7.3% y/y during the week ending 07 February 2024. Monthly number of GST e-way bills was 9.5cr units in December (after 8.8cr in November) and averaged 9.4cr in the December quarter.

US headline CPI was at 3.4% y/y in December, after 3.1% in November. In December, price momentum in energy goods, apparel, recreation, education and communication turned positive, while that in used vehicles eased. Momentum in housing moderated mildly but stayed strong. Core CPI was at 3.9% in December after 4% in October and November. Sequential momentum in headline CPI and core CPI increased while that in non-housing-core-services stayed high. US non-farm payroll addition in January (353,000 persons) was well above expectation and numbers for the recent months were revised up too. Growth in average hourly earnings increased to 0.6% m/m in January but that in average weekly earnings fell as the average weekly hours worked fell. The unemployment rate stayed flat at 3.7% and the labour force participation rate at 62.5%. Non-farm job openings as per the Job Openings and Labor Turnover Survey (JOLTS) picked up very mildly in November and December, with hires falling in November and quits falling in November and December. The job-opening-to-hires ratio for the non-farm sector is now 1.61, off the peak of 1.83 in March 2022 but higher than the pre-pandemic average of 1.18 in Jan-Feb 2020.

The FOMC (Federal Open Market Committee), left its policy rate unchanged again at its meeting in January (after doing the same since September) at 5.25-5.50%. The last hike was in July and it had hiked rates at every meeting from March 2022 to May 2023. However, the December 2023 meeting marked a pivot in the Fed's policy from potentially hiking rates further to likely no more hikes and to even discussing rate cuts this year. At the January meeting, it said economic activity was continuing to expand at a solid pace, employment and inflation goals are moving into better balance but that it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. The Fed Governor thus stressed on the need to see more good inflation data (same pace of disinflation seen in the las six months). Thus, although a 75bps rate cut is expected this year as per the Committee's Summary of Economic Projections from December 2023, the Governor said it will be unlikely the Committee will reach a level of confidence by the March meeting to start cutting rates. He also said the committee had some discussions this meeting on tapering the ongoing reduction of the Fed's balance sheet (i.e. tapering Quantitative Tightening) and that it plans to begin in-depth discussions on this in the March meeting.

In the February'24 monetary policy, RBI / MPC kept all rates unchanged as expected. The general assessment on growth is that of continued resilience backed by the momentum in investment demand, optimistic business sentiments and rising consumer confidence. This is also reflected in the GDP forecast for FY 25. On inflation, the progress on core inflation is noted and welcomed but so is the repeated occurrence of food shocks that is interrupting the pace of disinflation. Further supply side risks come from international geopolitical uncertainties.

The underlying template for now seems similar for RBI and the Fed: strong growth is allowing for monetary policy to be patient in seeing through the attainment of respective inflation targets. More specifically, and focusing on the Indian context now, with price volatility driven by supply side factors resurfacing from time to time in context of robust underlying growth, there is always a chance of inflation pressures generalising. Put another way, the central bank has the luxury to not try and take a forward looking call (e.g. try to anticipate the effect on aggregate demand going ahead from fiscal compression shown in the just concluded interim budget) since concurrent growth if anything is stronger than what was earlier forecasted and doesn't need any support for now from monetary policy.

RBI's liquidity approach has evolved since late last year. Thus while the entire rate hike cycle was conducted in an environment of abundantly surplus liquidity, since late last year the central bank had started to worry about the quantum of excess system liquidity as well. This was presumably to facilitate greater transmission from banks. In the most recent period, however, RBI has become more responsive to anchoring overnight rate towards repo. While the Governor has noted that core liquidity remains positive, this is expected to progressively deteriorate into the financial year end predominantly on account of seasonal rise in currency in circulation. This, alongside ongoing large fluctuations in government cash balance, may require continued active intervention to anchor overnight rates. In all likelihood, overnight rates will range between repo and MSF over the next month and a half; with zero tolerance from RBI for it falling below repo rate. Alongside continued pressure of issuances, this should keep corporate bond spreads elevated over this period.

With respect to the conditions accompanying the current monetary policy stance (incomplete transmission and inflation above 4%), these are valid only so long as growth momentum holds. If that changes, then the current projection on inflation will be sufficient for both a stance change as well as follow up rate cuts, in our view. Projected real policy rate considerations are immaterial today given the strong growth momentum, but won't be if this starts to change. To clarify, we aren't arguing for any significant drawdown in growth trajectory. It is well understood that India's structural growth drivers are strong. However, global cyclicality, fiscal compression, and the lagged impact of rate hikes are all reasons to expect some momentum slowdown in the year ahead. This, alongside the start of rate cuts in US and Europe around mid-year, should be enough to give more weight to voices within the MPC that are also closely tracking the evolution of real policy rates. Presumably Prof. Varma's is one such voice, although we agree with the majority MPC that it is somewhat premature to be already actively contemplating rate cuts.

Outlook

We were open to the idea of some soft indications of an impending shift in the liquidity stance, if only to determine whether RBI's response to overnight fluctuations around the repo rate will be symmetrical or not. In the post policy press conference, Deputy Governor Patra did assert (later reiterated by Governor Das) that the objective is to keep weighted average overnight rate at repo rate. However, we would await further action here to be confident that this will indeed be the case, especially with anticipated declining core liquidity. That said, there isn't much in the form of additional takeaways from the policy in our view. It is appropriate to continue to focus on inflation so long as growth momentum is this strong. However, the guidance may not be a line in stone and considerations like real policy rate may gain more weightage as growth momentum slows.

Our bullish view on bonds isn't predicated on an early or deep rate cut cycle (https://bandhanmutual.com/article/15865), but rather on the ongoing transformation in India's underlying macro economic dynamics in context of greater foreign participation given impending bond index inclusion. This has potential to cut risk premia on bonds which most likely will be seen in continued compression in term premia. Thus bond performance is not as constrained by the extent of rate cuts as it would be if the starting point was flatter term premia (overnight rate to duration bond yield) and if one was only playing duration for cycle reasons. In fact, the view that one needs to be less tactical and more structural is even stronger post the budget where we, along with everyone else, have been very pleasantly surprised with the extent of fiscal consolidation the Finance Minister has put on the table.

We continue with overweight 30 year government bonds in our active duration and gilt funds. More broadly, we reiterate that focus of investors should be on appropriate duration enhancement as per risk appetite and a greater focus on quality bonds, unlike the focus on minimizing duration and maximizing carry that has been the dominant theme over the past couple of years.

Data Source: CEIC, PIB, US Federal Reserve, Bandhan MF Research. Data as on latest available